– Practical Applications – Do and Act.

” Whatever you do may seem insignificant to you, but it is most important that you do it.”

Mahatma Gandhi

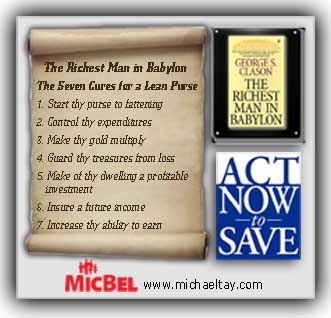

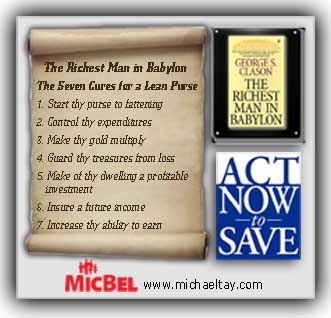

The Richest Man in Babylon - 7 cures for a lean purse

In my earlier posts, I have shared in summary and in details, the 7 main laws of accumulating wealth based on the principles from The Richest Man in Babylon. If you missed them, please refer to them again as it is important that you fully understand the concept and principles therein.

Now, you realize that to fully benefit and gain from acquiring this new knowledge, you need to apply it, don’t you? Knowledge without applying and taking action is of no value. The secret to succeeding, is taking ACTION! You must Do and Act on your new knowledge and understanding.

If you are not getting the results and success that you are desiring, you will have to change what you are presently doing and believing. Because, if you keep doing the same things that you are doing now, you will continue getting the same results as in the past. If you don’t like your current results, then you must start thinking and acting and doing things differently so that you will get different results – the results that you desire. Success and Financial Wealth.

The amount of your wealth and success you have now is strongly tied to your beliefs system and knowledge you are having and applying now in your life. Keep reading and you will see what you have been missing and if you are able to apply yourself differently, then you are on the road to financial success.

Here is the summary and practical applications of the main laws from The Richest Man in Babylon of accumulating wealth:

1. A part of all you earn is yours to keep. What you earn, a part of it is yours to keep. If you give away ( spend, buy stuff or toys, pay taxes, and others ) everything that you earn and are left with nothing, obviously you will have no savings and will not accumulate anything. So, no matter what happens, you must ensure for yourself, that a part of all that you earn is yours to keep. And this part of it will be your savings of at least 10% of all you earn, not to be spend on bills, purchases, taxes or anything else that doesn’t earn you more money. Ensure you Pay Yourself first.

There is a saying. “ Rich people save first and spend the rest, whilst poor people, spend first and save what’s left.” The difference is not in the amount, but in the philosophy of what they do with their money.

2. After setting aside 10% for savings, which leads us to the next point. Control your expenses so that you are able to keep at least 10% or more, of all that you earn and you are able to live without running out of money, which is the financial blood of any financial system. Here, we are talking about your own personal financial system. The only way, you can do this, is that you must know what your money is doing, where it comes from, and where it goes and that you are able to account for the cashflows.

Is your money buying assets or spending liabilities? Buying assets will grow your wealth, whilst spending on liabilities and thinking it’s an asset will take cash away from you. You must start keeping records, specifically a budget, an income and expense statement, a cash flow statement and your Net Worth statement. You need to know where you are now financially. If you don’t know your net worth today, then how are you to plan where you want to be financially one year , 5 years or even 10 years from now.

3. Once you have started and form the habit of saving at least 10% of all that you earn, you must make it multiply, you must make your money work hard for you. Make your money to bear children, grow and work for you to make more money. This is where you begin to multiply your money through compounding growth, understanding the rule of 72 and wise investments. You let your money bear more of its own kind – more money and more money. Isn’t this exciting?

In other words, invest it well and accumulate assets and it will make you more money than you can possibly do yourself. When your investments and assets bear fruit, don’t consume all the fruits! Re-invest most of your investment gains back again to build more assets – this way, your assets and wealth will grow in leaps and bounds until you amass a massive capital that becomes your financial golden goose that will provide continuous monthly cash flow incomes to support your desired lifestyle.