The Rule of 72 – Multiply Your Gold

The Rule of 72

Anybody here knows of the Rule of 72 and how it works?

To assist you to do compound interest problems mentally, the Rule of 72 gives you a fast way to determine how good (or not so good) a potential investment is likely to be. Rule of 72 is a simple way of working out how long it takes approximately to double your investment.

The rule of 72 says that in order to find the number of years required to double your money at a given interest rate, you can just divide the interest rate into 72.

For example, if you want to know how long it will take to double your money at two percent interest, divide 2 into 72 and get 36 years. The rule of 72 is remarkably accurate, as long as the interest rate is less than twenty percent.

You can also run it backwards. If you want to double your money in ten years, just divide 10 into 72 to find that it will require an interest rate of about 7.2 percent.

It is a very powerful tool for you to plan your finances.

Say, if you put $1000 in your savings account at 2% interest rate.

According to the Rule of 72, it will take you 36 years to double up your money to $2000.

72 / 2 = 36 years.

Now why is this Rule so important.

Allow me to demonstrate why the rich multiply their gold much faster than the poor and middle class people.

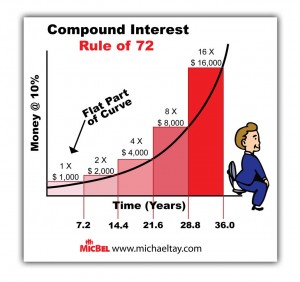

Say, we start with $ 1,000 with the following assumptions:

Savings Acounts at 2%

Fixed deposits at 3 %

Government Bonds at 5%

Unit Trust (Balance) at 7.2%

Unit Trust (Aggressive / Growth) at 10%

Equities at 20%

To double up your money from $1,000 to $2,000, it will take you the number of years if you invest your money in the respective asset class.

Savings 1000 to 2000 ———————— 36 years

Fixed Deposits 1000 to 2000 ————— 24 years

Bonds 1000 to 2000 ————————– 14.4 years

Unit Trust (Balance)1000 to 2000 ——— 10 years

Unit Trust 1000 to 2000 ——————— 7.2 years

Equities 1000 to 2000 ———————— 3.6 years

Now you see, all these concepts ties in.

In the illustration, a person who save their money in a savings account will double their $1,000 to $2,000 in 36 years, whereas someone who invest with a higher rate of return of 10%, will grow their money from $1,000 to $32,000 in 36 years.

If you spend all you get, then this Rule will never work for you. It’ll never get your money working for you.

You work hard for your Money, that is Man at work. Now you must make your Money work hard for you, that is Money at work

Here is a question for you. In what situation does compounding not work for you?

When you break the chain of compound interest. That’s why one of the rule for the money game is never, never, ever break the chain of compounding.

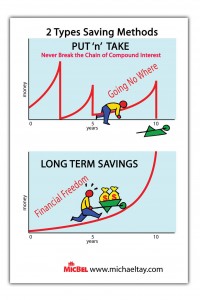

How do people break this chain? When they follow the PUT ‘ N TAKE method.

We put in! and then we take out. We put in and we take out. Instead of long term saving and allowing compound interest to work for us, most of the savings plan work like this. We get our salary, and put money in the bank thinking we will save. Oops, something happens, and we take money out from the account.

Later, we get our bonus, and we put in as well, but then our car breaks down and need repairs, and we find that we have to take money out to fix it. Sounds familiar, right ? We put, we take.

The moral of the story is to start invest early and never break the chain of compounding.

I hope you have enjoyed this as much as I love to share it.

To your success and financial abundance. ![]()

By Michael Tay www.michaeltay.com

Feel free to reprint this article in its entirety in your ezine or newsletter, or on your blog or website, as long as you leave all links in place, do not modify the content and include our resource box as listed above.