The Rule of 72 – Multiply Your Gold

The Rule of 72

Anybody here knows of the Rule of 72 and how it works?

To assist you to do compound interest problems mentally, the Rule of 72 gives you a fast way to determine how good (or not so good) a potential investment is likely to be. Rule of 72 is a simple way of working out how long it takes approximately to double your investment.

The rule of 72 says that in order to find the number of years required to double your money at a given interest rate, you can just divide the interest rate into 72.

For example, if you want to know how long it will take to double your money at two percent interest, divide 2 into 72 and get 36 years. The rule of 72 is remarkably accurate, as long as the interest rate is less than twenty percent.

You can also run it backwards. If you want to double your money in ten years, just divide 10 into 72 to find that it will require an interest rate of about 7.2 percent.

It is a very powerful tool for you to plan your finances.

Say, if you put $1000 in your savings account at 2% interest rate.

According to the Rule of 72, it will take you 36 years to double up your money to $2000.

72 / 2 = 36 years.

Now why is this Rule so important. Read the rest of this entry »

The Miracle of Compound Interest

Hope you like my previous post on the 3rd rule to multiply your gold.

The Miracle of Compound Interest

Continuing with this 3rd rule, how do you multiply your gold and financial abundance? You need to reinvest your hard earned money for compounded growth. By using Compound Interest. Really, the key to wealth is compounding.

Albert Einstein called compound interest the eighth wonder of the world. And compound interest works because as time increases, interest increases exponentially. In other words, the interest builds on the interest.

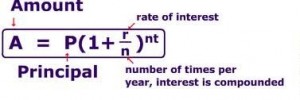

Let’s understand how to calculate Compound Interest

FV – Future Value

PV – Present Value

i – Interest

n – No. of compounding periods

Time and rate of return (ROI) will work magic on an initial investment through compound interest. And you MUST make this as a cornerstone of building your wealth. By compounding a few dollars a day over time can create your fortune. Read the rest of this entry »

Multiply Your Gold – 3rd Rule of Wealth Building Principles

Here is the 3rd rule of Wealth building principles from The Richest Man in Babylon.

Make thy Gold Multiply

Make Thy Gold Multiply or in simple terms “Multiply your gold or Make your assets multiply”.

Make your money multiply – Make your money work for you, then its sons [interest] and the sons of their sons. Investing your money through investments and opportunities for asset building. Then your wealth multiplies fast.

We have work hard for money and pay ourselves first. Then we have decided to control our spending which allows us for higher savings and investment to build our seed capital for investments. This is the exciting part where we make our money work hard for us.

However, in reality, most people don’t know how to make their money work hard for them.

They think they are growing their money though savings in bank, earning a small return of 2%, whilst yearly inflation rates are eroding their value of money.

So, how do you multiply your wealth? What does multiply your gold mean ? It means invest and grow your money.

You need to invest for compounded growth which is the key to building your wealth. Compound growth requires time, rate of return, amount invested and frequency. The real key for compounded success is Consistency and Self-Discipline.

“ Every gold piece that you save is a slave to work for you. Every copper it earns is its child that also earn for you.”

You need to Save and Invest the Difference.

In the beginning, your savings may be small, so put into a savings account that bears interest. Once the amount is sufficient, you can then invest in other higher interest bearing instruments, like FD’s, and buy assets like Government Bonds, Mutual funds, shares, properties.

In the book, Rich Dad, Poor Dad, Robert Kiyosaki mentioned as a number one rule, that you must know the difference between an asset and liability. And we must always buy assets. To simplify, asset put money in your pocket and liability takes money out of your pocket. If you want to multiply your wealth, you need to build your assets. Rich people acquire assets. The poor or middle class acquire liabilities but they think they are assets.

Therefore, to multiply your money and make sure your money work hard for you, you need to buy assets and use the greatest tool available to us to grow our money through compounding. Are you buying assets or are you buying liabilities ?

In my next post, I shall share with you the magic of compounding and the Rule of 72.

I hope you have enjoyed my sharing. To your success and financial abundance. ![]()

By Michael Tay www.michaeltay.com

Feel free to reprint this article in its entirety in your ezine or newsletter, or on your blog or website, as long as you leave all links in place, do not modify the content and include our resource box as listed above.